Projects

Domestic Laser Equipment Enters the Supply Chain of Lithium Battery Head Enterprises

In 2022, the production and sales of China’s power battery industry were 545.9GWh465.5GWh, with a year-on-year increase of more than double. In 2023, new production capacity of power battery manufacturers will gradually be released, driving further growth in China’s power battery production. According to data from the Battery Alliance, the production of power batteries in China in the first two months of 2023 was 69.6GWh, an increase of 13.3% compared to the same period in 2022.

In recent years, the prosperity of the global new energy vehicle market has greatly stimulated the demand for the power battery industry. In order to further expand production capacity and increase market share, power battery manufacturers continue to research and develop new products, improve process quality, and put forward higher requirements for laser equipment.

Before 2021, the lasers used in the core technology equipment of domestic power batteries were mostly foreign brands, making it very difficult for domestic manufacturers to enter.

Production line tested for over a year and successfully entered the supply chain of leading manufacturers

With the rapid expansion of power battery manufacturers’ production capacity, the demand for power battery manufacturing market is constantly leading Ye Sheng. Many domestic and foreign laser companies have rushed to enter the market, competing for a big cake. According to GGII data, the market size of lithium-ion laser equipment in 2021 was 10.13 billion yuan. Driven by the demand for new energy vehicles, it is expected that the demand for lithium-ion laser equipment will reach 2207 yuan in 2025, with a CAGR of 21.4% from 2022 to 2025.

As the core component of new energy, the production of power batteries includes three parts: electrode production (front section), electrical assembly (middle section), and post-processing (rear section). Fiber optic lasers are widely used in electrode cutting, electrode striping, plate cleaning, electrode ear welding, top cover full welding, adapter welding, sealing nail welding, explosion-proof valve welding, module Busbar welding, module positive and negative electrode ear welding, module external welding, and PACK disc support welding Battery marking and other processes.

The welding yield has significantly increased, once again breaking industry records

Compared to laser cutting, the barrier to laser welding process is higher. For a long time in the past, domestic laser manufacturers mainly focused on the application field of sheet metal cutting, with relatively little investment in laser welding technology and processes, and a relatively weak foundation. There are many welding parts for power batteries, which are difficult and require high precision. The requirements for automation, safety, precision, and processing efficiency of production equipment are extremely high. Laser welding is widely used in dry power battery pole ear welding, soft connection welding, top lamb wine welding/top cover full welding, sealing nail welding, explosion-proof thorough welding, module flow bar welding, and mold thin plate/side plate connection.

Taking pole ear welding as an example, the welding quality directly affects the overall performance, yield, and service life of the battery. The core of this process is to reduce splashing, ensure the integrity of the welded area after tearing the foil, and improve the cleanliness and welding speed of the welding area, thereby reducing the number of pores and explosion points.

Develop industry standards, from domestic substitution to domestic surpassing

Looking back over the past decade, with the continuous improvement of key technologies and industrial chain supporting facilities, the domestic laser industry has achieved rapid catching up with foreign manufacturers and begun to accelerate the implementation of domestic substitution, which is very evident in the field of fiber lasers. However, for the long-term development of the domestic laser industry, simply replacing foreign brands is not enough.

At present, the domestic laser industry is in a critical stage of transformation and upgrading. The good days of high profit margins and rapid market growth are gone forever, replaced by high internal competition, deteriorating price competition, and slowing industry growth. Faced with a new stage of development, the domestic laser industry has reached a critical point of striving for “internal strength”. To gain greater market share, in addition to replacing foreign brands in product functionality, it is also necessary to compete or even surpass foreign brands in product stability and quality. Through technological and process innovation, domestic product performance indicators can form industry standards. Only in this way can we truly lead the development of the laser industry.

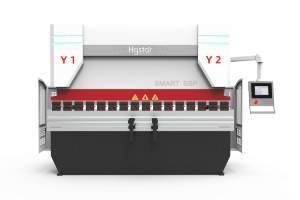

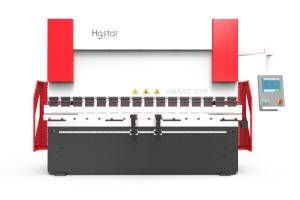

About HGSTAR: HGSTAR is is a sub-brand of HGTECH.HGTECH the pioneer and leader of laser industrial application in China, and the authoritative provider of global laser processing solutions. We have comprehensively arranged laser intelligent machine, measurement and automation production lines, and smart factory construction to provide overall solutions for intelligent manufacturing.